💎 Token Market

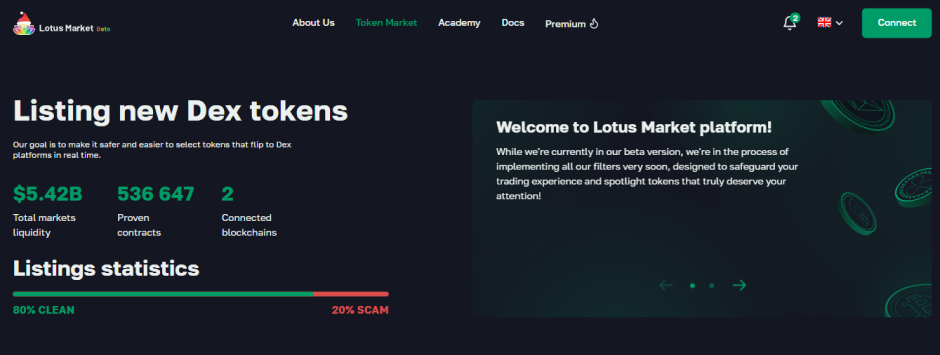

Lotus Marketis a platform that passes only new tokens released on Dex through its filters to ensure user safety from the various types of fraud present in today's DeFi market.

Our team of experts works to make the market of young and illiquid tokens clean and safe, helping investors to find good projects and creators to realize investments. At the moment, 75-80% of tokens entering the Lotus Market are clean, while 25-20%contain fraudulent schemes. And if we take the general market statistics, only two networks (ETH i BSC) launch about 50,000 tokens per month and 98-99% of them are pure intentional scams with no possibility to sell the purchased tokens.

Since the site went public, over half a million different smart contracts have been analyzed and two or by going to the ETH and BSC blockchains have been connected. As we connect all of our filters, we plan to scale to other networks.

We are successfully working on improving our filtering system to give our users the most comfortable and safe place to choose Dex tokens. Thanks to the feedback and attention of our users - we have the ability to catch fraudulent schemes and create security technologies that help to improve Lotus Market, only together we can achieve maximum results!

#Top Gains

Here you can familiarize yourself with our winners, which brought their investors the most profit. These can be meme tokens, technologically interesting projects, various web3 wallets, breeches, and more.

The winners for the last 24 hours, 2 weeks and a month are displayed here. We are actively working on improving these blocks so that they take into account not only the percentage growth of the token, but also other important factors.

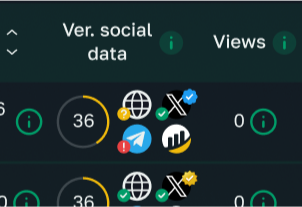

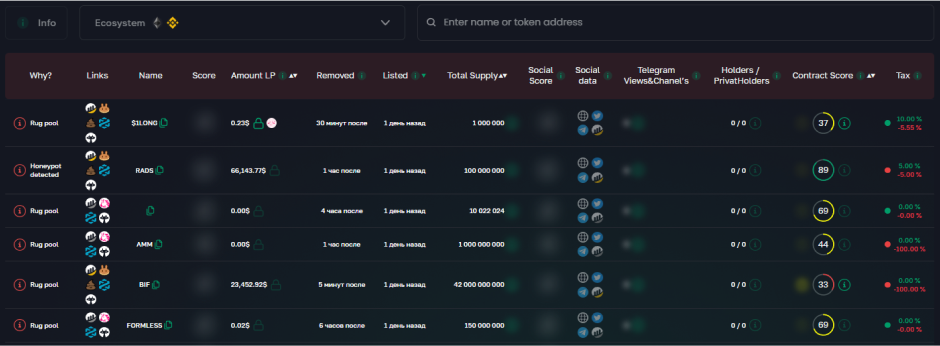

#Table of new tokens

If you pay attention, you can see hidden data that is only available to users with a premium subscription, this allows you to unlock unique access to hidden information providing deeper data analysis and advanced filtering capabilities.

To learn more about privileged access and its benefits, please see the following sections 🏆 Tier 1 and 👑 Tier 2 or by going to the Premium

#So what is the filtering functionality of our service?

The filtering functionality can be divided into three blocks, viz:

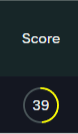

[1] Contract Score

This block contains all our analytical data related to the smart contract analysis;

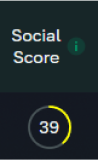

[2] Social Score

Here we will evaluate the token's social data, including site quality, social media activity, audience nature, verification rate, and success rate;

[3]docs.text_60

Total Score

The score is categorized into different risk groups: 0 to 33 is considered high risk , 34 The score is categorized into different risk groups: 69 is acceptable but requires further analysis, and 70 to 100 is considered the best factor.

#Contract Score

Investigating smart contract in tokens with low liquidity is an important step, , as often scam functions are embedded in such contracts, preventing users from selling their tokens. Our scanner, which uses an intelligent multi-level smart-contract analysis system created by professional auditors with the help of a neural network that identifies undesirable elements , making token selection as easy and convenient as possible. We have created an evaluation filter that displays contract quality from 0 to 100 to provide you with maximum simplicity and confidence in your choice.

.png)

All smart contract analysis is performed in automatic mode, where a multi-level source code scanning system is employed based on an available database of 1.5 million tokens

[1] We apply unique filters which, for security reasons, remain confidential and cannot be shared;

[2] docs.text74

-

Blacklist

(in detail in the article 🗞 Smart contracts with function BlackList )

-

AntiWhale

(in detail in the article 🗞 Smart contracts with function AntiWhale )

-

Proxy

(in detail in the article 🗞 Detector description Proxy )

-

Pauseable

(in detail in the article 🗞 Smart contracts with function Pause )

- Enable trading

- Cool-down

- Transfer limit

- loating fee

- Melt

- Mint

- Hidden mint

- External Call

- Balance modified

- Renounce ownership

- Hidden renounce ownership

- Dead blocks

- White-list

For a brief introduction to each type of vulnerability (see this one 🗞 Lotus Market's review... ). And for a more in-depth look, check out our blog.

[3] We analyze a smart contract based on its qualitative textual content, functionality, and the architecture used to write it;

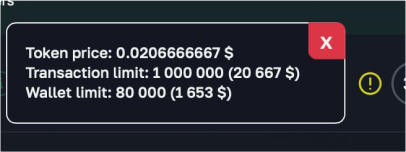

[4] We also define contract limits for buy/sell transactions, both in terms of volume per transaction and total number of tokens per wallet. This ensures that a user cannot buy more than they can successfully sell, thus ensuring successful transaction execution in trading, allowing you to work even with risky contracts by buying and selling exactly within the limits;

Secure terminal for searching tokens Score Contract (the widget's appearance is shown below). This greatly simplifies the decision-making process for the user when choosing a token by providing a comprehensive score based on risk and contract characteristics.

#Social Score

Currently, we are successfully solving one of the important and challenging tasks - providing information about new tokens that appear on decentralized exchanges (Dex). We collect data such as social media links, number of views and likes, audience quality and site quality - accumulating it all in a single platform for your convenience. In the process of listing a new token, few people have any idea what it is about and what work its creators have done. We have solved this problem by integrating multiple search engines that help identify and display data about new tokens on our platform (approximately 70-80% of tokens released on our platform have social data)

We then perform an analysis of this data:

[1] The quality of writing website code:

We examine the quality of the code used on the token site by analyzing the programming languages, functionality, architecture, and technologies used;

[2] Analyzing Twitter and Telegram:

We assess the quality and engagement of the audience on social media platforms such as Twitter and Telegram. We also check whether verification is in place;

[3] Scam Search:

We are searching for signs of fraud and scam in connection with this token;

[4] Display views and data from Telegram and Twitter feeds/chats:

We provide information about channels and chats on Telegram and Twitter where this token has been seen;

[5] Evaluation of data quality in channels/chats:

We determine the quality and credibility of the information presented in these channels and chats;

[6] Verifying the authenticity of social media:

We check whether the social media, owners own the smart contract;

[7] Twitter account verification for status:

We check the Twitter account for special status.

This detailed analysis provides our users with valuable insights and helps them make informed decisions when choosing new tokens to trade or invest in

We convert this analyzed data into a Social Score, giving users the ability to instantly assess the quality of a token based on external social data. Social Score serves as a tool to quickly and visually assess a token's social activity and trustworthiness, making it easier for users to make informed trading and investing decisions

#Total Score

After analyzing the data described above and taking into account additional factors that will be described below, we converted this data into a Total Score. Using an automated multi-level scanning system: from source code and social data to analyzing tokenomics and making predictions based on an existing database of 1.5 million tokens.

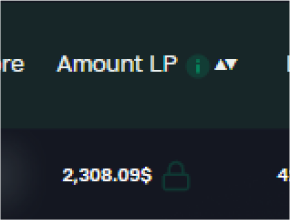

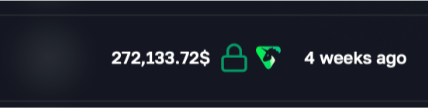

[1] The amount of pool liquidity::

We observe the size of the pool liquidity, which is a key factor in the stability and adherence of tokens;

[2] The presence of locus or combustion in the liquidity pool:

We collaborate with 5 token locus services, and this information adds additional dimensions to the overall token overview, allowing us to assess the level of transparency and control mechanisms over token supply;

Local liquidity period:

We also consider the duration of the liquidity locus. This is an important factor that can affect the stability and reliability of a token over a certain period of time;

[4] Analyzing the tokenomics of a token:

We provide tokenomics analysis, including data on the distribution and location of tokens.

This information allows users to estimate where and how many tokens are located, which is

important for forming a complete understanding of the economic structure of a token;

[5] Loc or Westing's analysis in tokens and their period:

We analyze whether lock or Westing is present in tokens and determine for how long they are expected to be in effect.

This is important information that allows users to assess the structure of token locks and their impact on the market;

Evaluating the impact of tokens owned by administrators on the liquidity pool:

We calculate how tokens in the hands of administrators may affect the liquidity pool and how much this may affect the price. This is an important aspect of analyzing the risk and sustainability of a token;

[7] Private Holder Analysis:

We study the number of private holders and estimate how their tokens may affect the liquidity pool. This helps us anticipate possible market impacts from the actions of this group of holders;

[8] Connection to lunchepads:

We track where the token came from by connecting to lunchpad sites such as Gempad, PinkSale, Uncx network, Dx.sale and others. This provides context and information about the launch structure of the token;

[9] Calculation of private holder yields as a percentage:

We compute data on the percentage return that private holders have realized. This information provides users with insight into the profitability of this group of holders and can be important for estimating the overall benefit of token ownership;

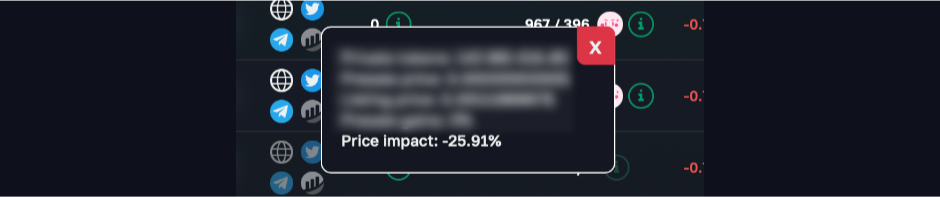

[10] Price Impact display:

We also provide users with information about "Price Impact" - how private holders can affect the price if they decide to sell all their tokens from the liquidity pool;

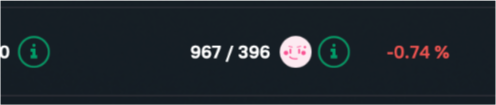

[11] Display the size of the buy and sell commissions:

We provide information on what commission will be charged when buying and selling a given token. This allows users to take into account additional costs when conducting transactions;

Data source honeypot.is

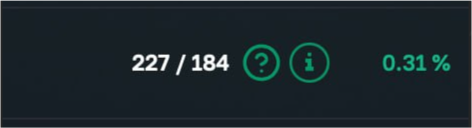

[12] Display the number of successful transactions:

We provide data on how many successful transactions have been made with a given coin. This information gives users an idea of how popular and active this token is on the market;

Data source honeypot.is

[13] Confidential Data:

We understand that for the sake of data analysis security, it is necessary to keep some information secret. This helps to ensure confidentiality and prevent possible threats to system and user security.

We understand that for the sake of data analysis security, it is necessary to keep some information secret. This helps to ensure confidentiality and prevent possible threats to system and user security. Your efforts in analyzing data and forming a comprehensive overview of a token are ultimately summarized under one Total Score. This total score

Lotus Market provides a unique opportunity to simplify most analysis processes (go to thePremium page) and offers more advanced functionality and privileges to users for an additional fee. There are three levels of Premium packages available in Lotus Market, offering a variety of features for improved user experience

🏆 Tier 1 👑 Tier 2 🏆 Tier 3

#Deleted tokens

This table is designed to keep track of tokens that have been taken off the market and to analyze the data provided to determine the best strategy when selecting a token.

We provide tips on avoiding certain cheating schemes to help users avoid similar situations in the future

Rug Pool A fraudulent scheme in which the project creator suddenly takes away liquidity, leading to a token price crash and losses for investors.

Liquidity security. Make sure that liquidity is locked or sent to dead wallets in the "Amount LP" column, determine this by the highlighted green lock icon or light. Pay attention to the duration of the liquidity lock - the longer the better.

Contract Evaluation. In Score Contract, investigate for suspicious functions such as "Hidden Mint" or "Mint", and be alert to any unusual or opaque operations in the contract.

Tokenomics and impact on price. Analyze tokenomics, especially in the "Price impact" column, also consider how available tokens on administrative wallets can affect the price.

Honeypot detected — is a fraudulent smart contract that attracts investors and then suddenly restricts or withdraws their funds, causing losses.

To protect yourself from a possible Honeypot detection, it is recommended to check for the absence of "Blacklist, External Calls, Floating Fee and Balance modified". In addition, do not forget to pay attention to the evaluation of the contract itself - this also plays a key role in your security.

High Tax — this refers to high taxes or commissions on transactions, which may affect profitability and trading efficiency.

Before investing in a token and avoiding unpleasant commissions, pay attention to the "Tax" column. It is also recommended to carefully examine the contract itself for the presence of "Floating Fee". This will help you make an informed choice and avoid possible unpleasant surprises associated with high commissions.

For a brief introduction to each type of vulnerability (see this one 🗞 Lotus Market's review... And for a more in-depth look, check out our blog. our blog

#Summary

With its unique and innovative features,Lotus Market becomes a reliable assistant for all users who want to trade cryptocurrency in Defi safely and comfortably. Such an initiative simplifies processes and makes the token market accessible and safe for a wide audience. Thanks to this, users are able to focus on what's important - choosing the right assets and making profits Already today we are shaping the future of safe DeFi investments and forming the standards of the future.

Español

Español Português

Português Русский

Русский Українська

Українська

About Lotus Market

About Lotus Market